As I mentioned above, I've qualified to receive a small pension from working in county goverment when I turn 65. There is absolutely no way I'm going to plan my retirement around that money. In my opinion, based on the current state of Illinois finances, state workers would also be foolish to plan their retirements around receiving 100% of their pensions.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Illinois Teacher Pensions

- Thread starter WildCat

- Start date

BenBurch

Gatekeeper of The Left

Even if you promise to pay back a usurious loan right?

Are you in the habit of defaulting on loans?

pipelineaudio

Philosopher

- Joined

- Feb 23, 2006

- Messages

- 5,092

We'll be OK after all the Republicans move to AZ.

No thank you!!! We've got WAY more than enough of you god damn midwest NIMBY snowbirds

Tsukasa Buddha

Other (please write in)

- Joined

- Sep 10, 2006

- Messages

- 15,302

Gotta say, the silly anti-union rhetoric and bemoaning of forced, evil, secret, extortion contracts is just silly, not to mention they wouldn't hold up in court. This is a numbers problem, and in Math we always show our work.

Linky.

As for Illinois:

Linky.

Illinois had one of the most unbalanced books before the economy tanked. Yes, things are bad and need to be changed. But instead of talking about Springfield vs local funding or adjusting the normal cost or anything reasonable, people seem to enjoy pulling huge numbers with no useful application and shouting about the "bankrupt" State. I've even read a few studies that suggest hybrid models, but again, no one cares because those ebil unions are gettingscrewed paid like the rest of us with 401k. Going to defined contribution would probably create more problems.

The decline in the funded status of pensions in the wake of the financial crisis has put state and lo-

cal governments under great pressure just as their budgets were decimated as a result of the ensuing recession. The response all over the country has been to increase employee contributions, cut benefits for future employees, and in some cases cut cost-of-living adjustments for current employees and retirees. To justify these changes, the story is that public employ- ees are overpaid and their pensions are a particularly egregious example of that overpayment.

At this point, observers generally agree that wages of similarly situated workers are lower in the state- local sector than in the private sector. The disagree- ment hinges on the extent to which benefits offset the wage penalty. Our re-estimation of the much-used wage equation plus adjustments for proper valuation of pensions and retiree health insurance indicates that the two roughly balance out. The estimated difference nationwide is about 4 percent in favor of private sector workers.

In short, for the nation as a whole the difference between public and private sector compensation appears modest. The relatively modest differential should make policymakers cautious about massive changes without carefully studying the specifics of their particular situation.

Linky.

As for Illinois:

Studies, task forces, etc., have all concluded the same thing: the state has not paid its required contributions. In 1996 legislators recognized this and passed a law requiring an increase in contributions each year to bring the pensions up to their required funding level of 90 percent. Then the legislators broke the law and made partial payments. Think of it like your credit card bill – if you fail to make a payment or merely pay the minimum, you are assessed fees, thereby increasing your bill. That is what the state of Illinois has done to itself.

For 2011, the state owes TRS $2.4 billion. Only $715 million would be required to pay this year’s contribution if the state had been paying its bill each year. But, another $1.7 billion is needed to make up for past unpaid costs.

Linky.

Illinois had one of the most unbalanced books before the economy tanked. Yes, things are bad and need to be changed. But instead of talking about Springfield vs local funding or adjusting the normal cost or anything reasonable, people seem to enjoy pulling huge numbers with no useful application and shouting about the "bankrupt" State. I've even read a few studies that suggest hybrid models, but again, no one cares because those ebil unions are getting

sarge

Penultimate Amazing

I gotta say, all this "we made a deal with the unions, and we must pay no matter the impact on the rest of the state or how bad the deal was in the first place" stuff is just silly. Ignoring facts just to further a personal pro-union, anti-citizen stance, despite the clear evidence that the state will never be able to fund the pensions, gets you no closer to the inevitable........the structure of state pensions will change.

KoihimeNakamura

Creativity Murderer

I gotta say, all this "we made a deal with the unions, and we must pay no matter the impact on the rest of the state or how bad the deal was in the first place" stuff is just silly. Ignoring facts just to further a personal pro-union, anti-citizen stance, despite the clear evidence that the state will never be able to fund the pensions, gets you no closer to the inevitable........the structure of state pensions will change.

Strawman detected.

No because I carefully look at the terms before agreeing, but if a usurious contract slipped by me, I'd have no problem contesting it and forcing the terms to be amended.Are you in the habit of defaulting on loans?

BenBurch

Gatekeeper of The Left

Unlike yourself, I'm not an expert, but I have been looking at this for quite a while.

Revenue estimates for the state next year are $9.916 billion.

An increase of around 3% in income taxes would double this amount.

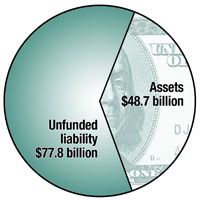

80 billion unfunded / 9.916 billion per year is 8 years.

12 years if we raise taxes 2%.

16 years if we raise taxes 1%.

Fixed.

Conclusion; You Republicans are saying "Hooray for me and **** you!" to all of the people who have worked keeping this state running for your whole lives.

WildCat

NWO Master Conspirator

- Joined

- Mar 23, 2003

- Messages

- 59,856

There isn't? Please list the sponsors of the legislation, for example, that allowed union bosses to collect public pensions based on their union salaries. Also list who voted for the legislation.There is nothing secret about a public contract.

No secrets Ben, this should be no problem!

BenBurch

Gatekeeper of The Left

No because I carefully look at the terms before agreeing, but if a usurious contract slipped by me, I'd have no problem contesting it and forcing the terms to be amended.

So, you admit that if YOU made an error, you would renege on your word?

Remind me to never enter into any contract with you.

BenBurch

Gatekeeper of The Left

There isn't? Please list the sponsors of the legislation, for example, that allowed union bosses to collect public pensions based on their union salaries. Also list who voted for the legislation.

No secrets Ben, this should be no problem!

I'll let YOU research it first. When you have, show me your research and I'll find what is wrong with it. Free.

If you want me to do the whole considerable job for you, my fees are $150/hr, portal-to-portal plus expenses and a $200 per diem.

WildCat

NWO Master Conspirator

- Joined

- Mar 23, 2003

- Messages

- 59,856

Show your math Ben, these numbers look like fantasy to me. Especially since the recent 66% income tax increase raised just $6 billion, nearly all of it going directly to pension payments. And the increases in liabilities still outstrips the revenues projected.Unlike yourself, I'm not an expert, but I have been looking at this for quite a while.

Revenue estimates for the state next year are $9.916 billion.

An increase of around 3% in income taxes would double this amount.

80 billion unfunded / 9.916 billion per year is 8 years.

12 years if we raise taxes 2%.

16 years if we raise taxes 1%.

Fixed.

Conclusion; You Republicans are saying "Hooray for me and **** you!" to all of the people who have worked keeping this state running for your whole lives.

BenBurch

Gatekeeper of The Left

The math is right there.

WildCat

NWO Master Conspirator

- Joined

- Mar 23, 2003

- Messages

- 59,856

The Chicago Tribune was unable to discover this information, and oddly none of the legislators contacted by them (including Mike Madigan and Cullerton) could recall who sponsored the bill, which was passed by a unrecorded voice vote.I'll let YOU research it first. When you have, show me your research and I'll find what is wrong with it. Free.

If you want me to do the whole considerable job for you, my fees are $150/hr, portal-to-portal plus expenses and a $200 per diem.

You claim this is public record and there are no secrets, you prove it.

I feel no obligation at all to be bound to sweetheart deals made in back rooms in secret by our corrupt legislature.

WildCat

NWO Master Conspirator

- Joined

- Mar 23, 2003

- Messages

- 59,856

No it's not. And what is there is incorrect. You claim a 3% increase in income taxes will raise over $9 billion, when a 66% increase raised just $6 billion?The math is right there.

That's mathematical nonsense Ben.

Sure, because the greater good is the fairness of the contract. If someone tricked you into a contract that was grossly unfair, wouldn't you demand that it be amended? If someone hoodwinked your grandma into signing a contract that was grossly unfair that no reasonable person would have agreed to knowing all the facts, would you demand that she honor the contract?So, you admit that if YOU made an error, you would renege on your word?

The law also allows for bankruptcy which permits cancelling of contracts.

You have this odd argument that terms once set, they can never be changed no matter what the situation, when we as a society clearly say that there are times when the right thing to do is to change a previous agreement.

sarge

Penultimate Amazing

Unlike yourself, I'm not an expert, but I have been looking at this for quite a while.

Revenue estimates for the state next year are $9.916 billion.

An increase of around 3% in income taxes would double this amount.

80 billion unfunded / 9.916 billion per year is 8 years.

12 years if we raise taxes 2%.

16 years if we raise taxes 1%.

Fixed.

Conclusion; You Republicans are saying "Hooray for me and **** you!" to all of the people who have worked keeping this state running for your whole lives.

Total revenue is about $10B and increasing taxes a mere 3% would double the revenue? That ranks among the biggest math errors ever posted. If your current tax rate is only 3% and you doubled your taxes, you would double your revenue.

Actually, I think your numbers are all wrong. If the pensions are $80B short and the state has revenue of only $10B a year, then the state couldn't pay the debt in 8 years unless they cesaed to do anything else but collect taxes and funnel it all to the pension fund.

sarge

Penultimate Amazing

Strawman detected.

Nope. It is the exact argument presented by at least one poster, and is an exact copy of the hyperbole exhibited in your post.

Virus

Philosopher

- Joined

- Jun 19, 2006

- Messages

- 6,875

Conclusion; You Republicans are saying "Hooray for me and **** you!" to all of the people who have worked keeping this state running for your whole lives.

Not a Republican.