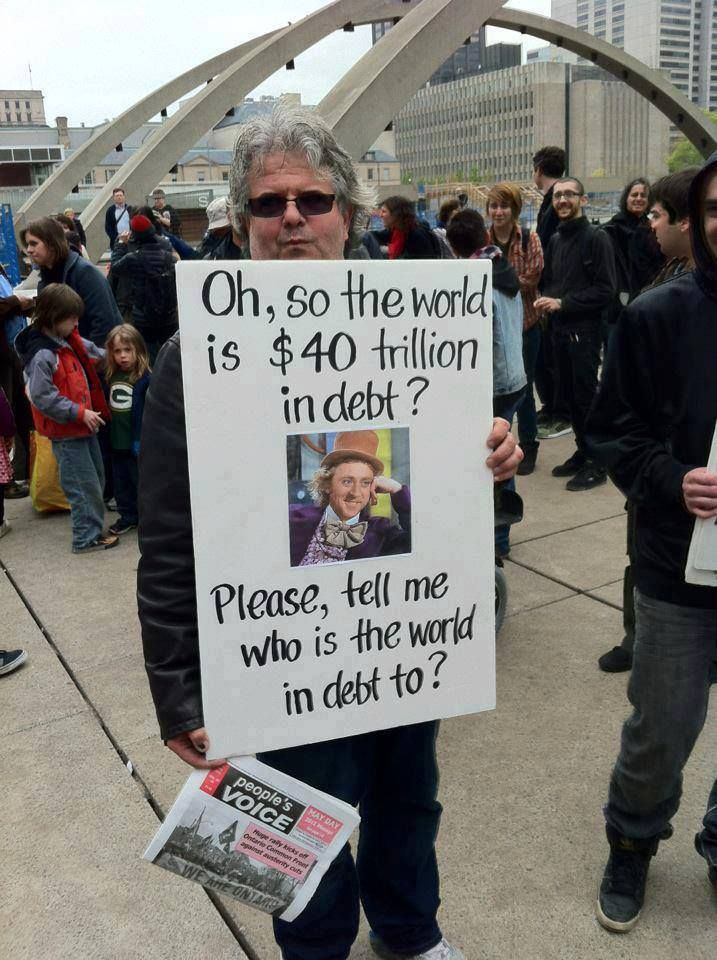

A friend posted this on Facebook:

It was from a page called "The Other 98%".

Surely there's a non-occutard explanation for this.

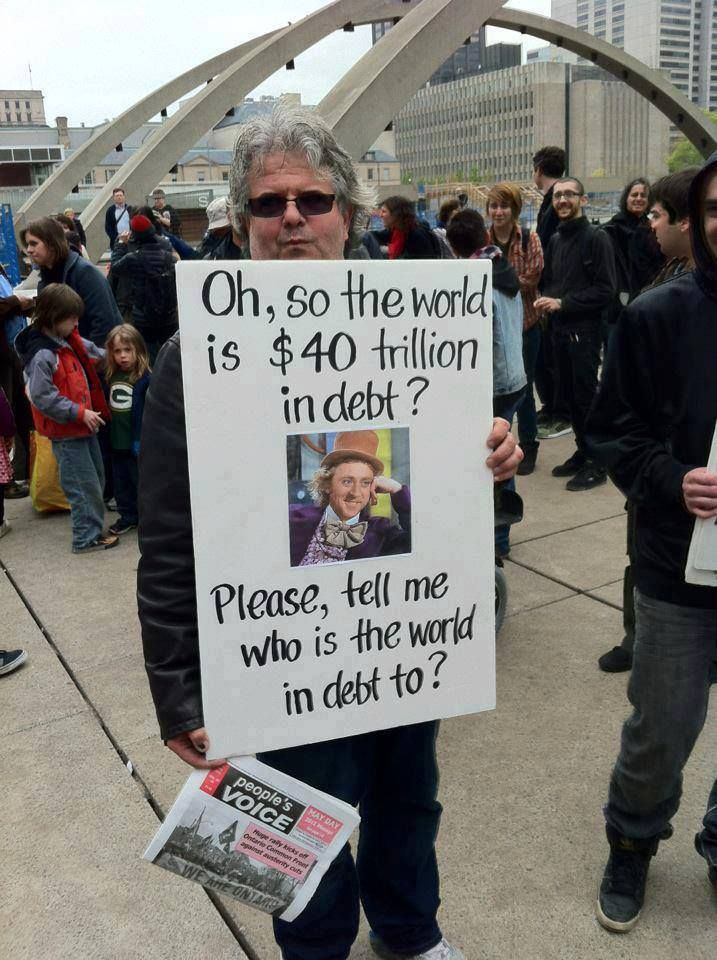

It was from a page called "The Other 98%".

Surely there's a non-occutard explanation for this.