Production decline

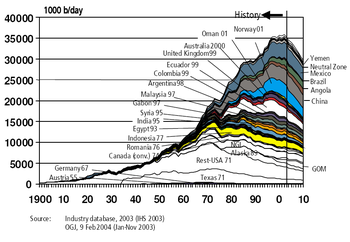

Luis Ramírez Corzo, head of PEMEX's exploration and production division, announced on August 12, 2004 that the actual oil output from Cantarell was forecast to decline steeply from 2006 onwards, at a rate of 14% per year. In March 2006 it was reported that Cantarell had already peaked, with a second year of declining production in 2005. For 2006, the field's output declined by 13.1%, according to Jesús Reyes Heróles, the director-general of PEMEX.[4]

In July 2008, daily production rate fell sharply by 36% to 973,668 barrels per day (155,000 m3/d) from 1.526 million barrels per day (243×103 m3/d) a year earlier.[5] Analysts theorize that this rapid decline is a result of production enhancement techniques causing faster short-term oil extraction at the expense of field longevity. By January 2009, oil production at Cantarell had fallen to 772,000 barrels per day (123,000 m3/d), a drop in production of 38% for the year, resulting in a drop in total Mexican oil production of 9.2%, the fifth year in a row of declining Mexican production