JoeTheJuggler

Penultimate Amazing

- Joined

- Jun 7, 2006

- Messages

- 27,766

Romney's always been reasonably in the race, and since the first debate, he's clearly been at or near the lead.

Near the lead? You mean in second place?

Romney's always been reasonably in the race, and since the first debate, he's clearly been at or near the lead.

FWIW, the Romney campaign has also been spending money on TV ads especially in swing states. So I'm not sure the he "has done nothing to bring it up" is a true statement.

And there's also the outside organization ads.

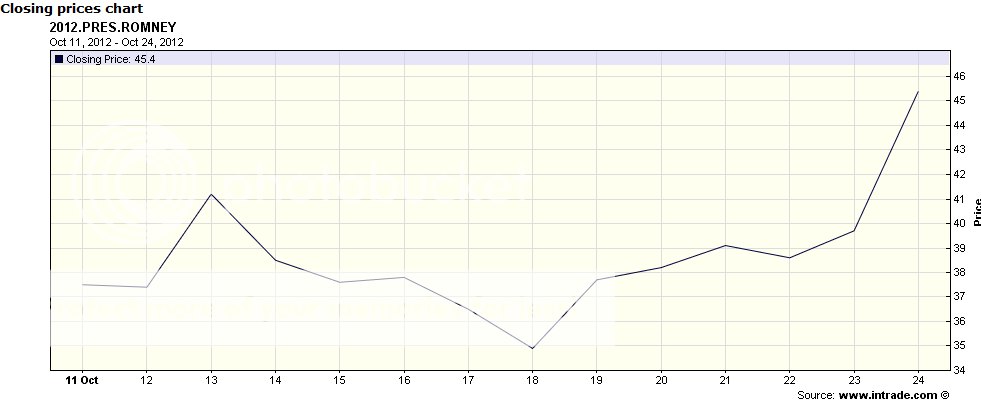

I'll give you that, but those ads have been going for weeks, and they wouldn't explain the sudden, massive shift towards Romney at Intrade which has occurred in the last day or so. The evidence of manipulation by large share buys by only a few investors does explain this shift, especially because we have evidence of exactly the same thing occurring in 2008.

Smoke and mirrors, folks. Smoke and mirrors.

I think it's some of both.

The manipulation explains the spikes in Intrade yesterday, but there has also been a trend in Romney's favor in the polls which has in fact been a more gradual change over the last few weeks (with pronounced jaggedness--volatility).

Even Silver's analysis reflects that this has happened. On Oct. 5, he had Obama at nearly 85% chance to win, and now it's at 68%.

And if you read into it a little you will see that the only reason Obama is at 68% now on 538 is because of his slightly tenuous lead in Ohio.

Do you mean if he had a stronger lead in Ohio, he'd be much higher that 68%? Or do you mean if he didn't have a discernible lead in Ohio, he'd be even lower than that? (Because Obama has had a stronger lead in Ohio, and Ohio has been closer than it is now a couple of times.)

I think you mean the former. If so, I agree, and it looks as if Silver recognizes that as a real change rather than just an artifact of prediction market manipulation.

Spikes are by definition transitory and temporary. That's not what been happening since the 18th. Your continued harping and citing the manipulation article smells of a conspiracy mindset.I'll give you that, but those ads have been going for weeks, and they wouldn't explain the sudden, massive shift towards Romney at Intrade which has occurred in the last day or so. The evidence of manipulation by large share buys by only a few investors does explain this shift, especially because we have evidence of exactly the same thing occurring in 2008.

Smoke and mirrors, folks. Smoke and mirrors.

Spikes are by definition transitory and temporary. That's not what been happening since the 18th.

This has been happening since the 18th. The article that keeps getting cited talks about spikes that last for minutes. When those types of spikes occur, people jump on them and the market self corrects. Something that lasts for days, like this is not a market manipulation issue:Nothing has been happening, really. Romney's price has been largely consistent since right about mid-May, except for a sharp downward spike after the 47% video was released, and a rebound after the first debate. And it's sitting there hovering right around 40-ish.

The market reflects everyone's attempt to take advantage of pricing they think is in their favor. To dismiss market sentiment and trends as "manipulation" is indeed hand waving or conspiracy nuttiness.The manipulation reveal simply means that indeed it's correct to assume that the last couple days are nothing more than a Romney supporter panicking and trying to force InTrade to match his preconceived notions.

This has been happening since the 18th. The article that keeps getting getting cited talks about spikes that last for minutes. When those types of spikes occur, people jump on them and the market self corrects. Something that lasts for days, like this is not a market manipulation issue:

What part of "This has been happening since the 18th. " do you not understand? What part of a "For about six minutes" from the article do you not understand? Here's a clue 6 min. <> 6 days.The spike from "around 40" (normal) to "near 46" between yesterday and today is exactly what the market manipulation article describes -- one Romney loon with a fat wallet and poor impulse control.

So says the guy that that misinterprets the article, can't tell the difference between minutes and days, and ignores a 6 day trend.I realize acceptance of facts isn't your strong suit, but come on, dude, it's right there in black and white in front of you.

What part of "This has been happening since the 18th. " do you not understand?

Did you look at your own chart?

Plot the trend line between the 11th and 23rd. Same ol', same ol', especially taken in context of my own diagram indicating that InTrade has been hovering around 40% for the past 5+ months.

The spike from "around 40" (normal) to "near 46" between yesterday and today is exactly what the market manipulation article describes -- one Romney loon with a fat wallet and poor impulse control. I realize acceptance of facts isn't your strong suit, but come on, dude, it's right there in black and white in front of you.

Brad Plummer WP blog 10/23 said:Update: Over at the Atlantic, Carl Wolfenden, the exchange operations manager for Intrade, says, “We checked this out for potential manipulation—it certainly fit the pattern at first glance.” But, he says, that doesn’t seem to be the case this time around. The Romney blip was apparently driven by a number of traders during an early-morning period when the market was very thin, rather than just one person.

Brad Plummer WP blog 10/23 said:Political junkies and campaign reporters often pay close attention to Intrade, a prediction market where investors bet on things like the outcome of the 2012 presidential election. The idea is that the collective wisdom of traders can offer a more accurate take on events than the occasional poll. (It doesn’t hurt that Intrade correctly predicted the outcome of the 2008 election.)

To be frank I find nothing skeptical about this. It looks like wishful thinking to me. A skeptic would tell his nephew what the polls were. During the summer the polls showed Obama significantly ahead.Actually InTrade is in line with most of the polls, except that it does not yet have Romney favored. You can argue that it is not in line with most of the other prediction markets. I have pointed out in the past that the IEM may be biased towards Democrats because they paid out on Al Gore contracts in 2000, because their model is solely based on who wins the popular vote.

If Romney maintains a lead at RCP or even declines somewhat, I would fully expect the markets to show a steady uptick in his stock value. That is just sensible given that the election is most likely to be close. That said, it will either be a romp for Romney, a close win for Romney or a very close win for Obama. I think Obama's chances of a strong win have disappeared.

Why do I still say there's a chance for a very close win for Obama? Well, this summer my nephew (seventh grader) asked me what it meant to be a skeptic. And I told him it meant that even if you thought something was unlikely to happen (or vice-versa), but you weren't sure and you were rooting for it not to happen (or vice-versa), then you should have a substantial skepticism about your own desires and beliefs coming true.

Of course it exists. You could also look at data 3 months ago, but that wouldn't be relevant to the changing market dynamic, and wouldn't address the recent discussion WRT the change in market sentiment, would it?Just because you cherry-picked only the data from the 18th on doesn't mean that the data from the 11th through 17th doesn't exist.

So says the guy that fails again to follow the discussion and has to look for weeks old data to support his point. Really, your juvenile insults are backfiring terribly.It appears that reality conflicts with your desires again. That's a shame.

Thanks. This should put the conspiracy to rest regarding the 6 minute spike: "So we don't believe this was manipulation but more a run on Romney when the market was unusually thin."Did everyone see this addendum?

Of course it exists. You could also look at data 3 months ago, but that wouldn't be relevant to the changing market dynamic, and wouldn't address the recent discussion WRT the change in market sentiment, would it?

... like for 6 minutes. Oh, and here's another clue for you regarding trends. Every long term trend started as a "short term fluctuation."Well, yes... see... that's how trend lines work, and how more reality-based people avoid getting over-excited about short-term fluctuations that don't actually mean anything

... like for 6 minutes. Oh, and here's another clue for you regarding trends. Every long term trend started as a "short term fluctuation."

Yeah, once money is on the line things change. Anyone who has played poker knows that money has a way of focusing one's intellect to more accurately calculate odds of success.

Well, if you think it isn't just a short-term fluctuation, there's plenty of time for you to get in the markets, or in the betting thread. I think Matt and Ben have been looking for someone to put money down on Romney's side for awhile now -- be sure to bet big!

Well, yes... see... that's how trend lines work, and how more reality-based people avoid getting over-excited about short-term fluctuations that don't actually mean anything -- such as the one between September 13th and October 13th.

I'm going to enjoy November 7th so much.